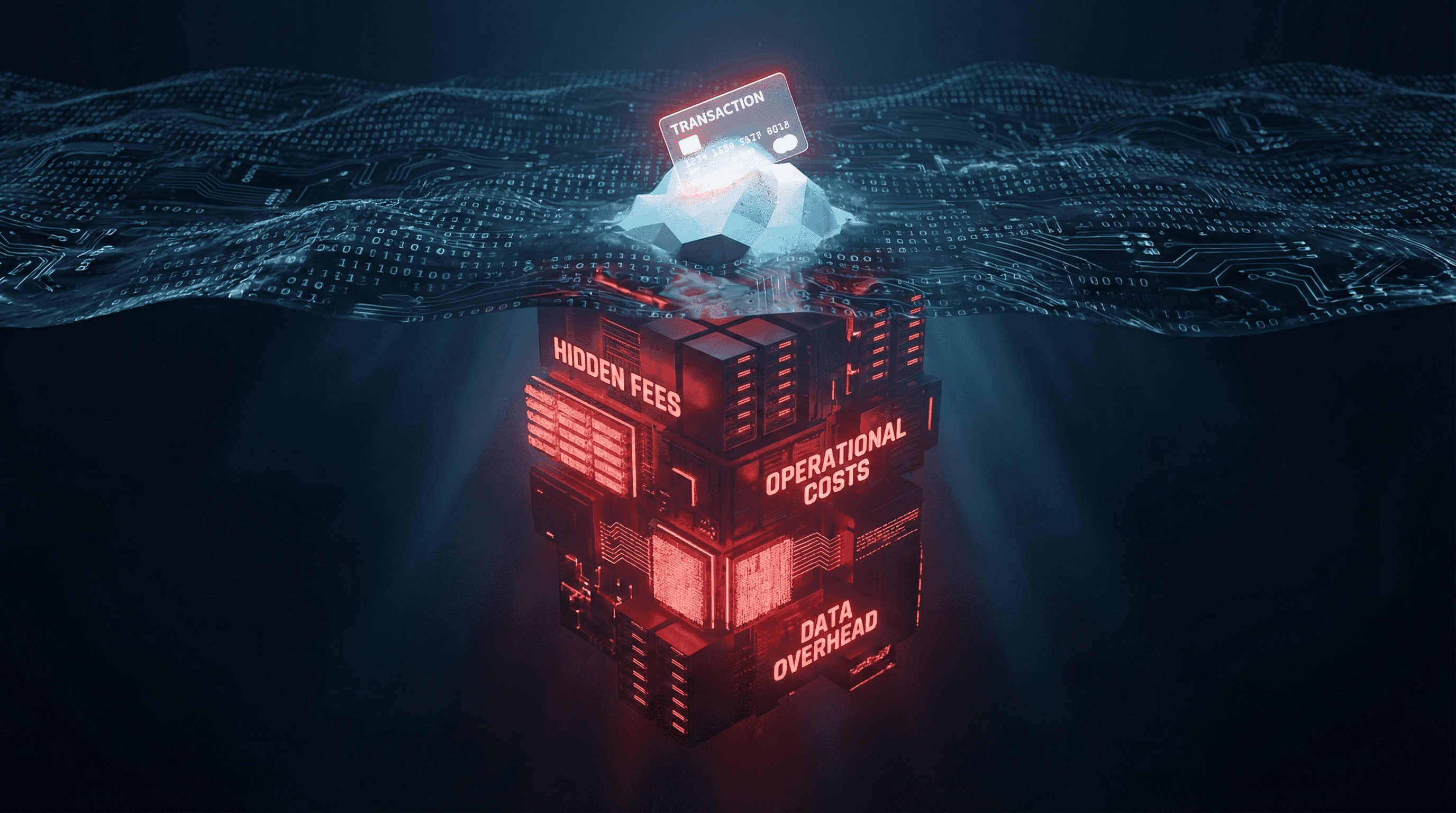

The $400+ Problem Hiding Behind Every $100 Chargeback

Why every disputed transaction costs 4x more than you think and threatens your entire payment processing capability

The $400+ Problem Hiding Behind Every $100 Chargeback

A customer disputes a $100 charge. Most business owners see it as exactly that. A $100 problem. You refund the money and move on.

But here's what they miss. That single chargeback actually costs over $400. Sometimes it puts the entire business at risk.

Chargebacks are currently costing businesses $33.79 billion a year. That number is projected to hit $41.69 billion by 2028.

The costs you can see

Start with the obvious. A $100 transaction dispute triggers immediate fees:

| Cost Item | Amount |

|---|---|

| Refund to customer | $100 |

| Chargeback fee | $15-30 |

| Alert fee | $25-50 |

| Subtotal (before any work) | $140-180 |

You're already at $140 to $180. And you haven't spent a single minute of staff time yet.

The costs you can't see

This is where it gets expensive. Every chargeback eats up hours of work. Your team gathers transaction records. They pull customer emails. They find shipping confirmations. Someone writes a rebuttal. Someone else submits all the documentation. Then you follow up to see what happened.

Most businesses spend 3 to 5 hours of staff time on a single chargeback. Spread that across customer service, operations, and finance. At $50 an hour, that's another $150 to $250 in costs that never show up on your chargeback report.

Then there's the product itself. If you shipped physical goods, you lost the item and can't get it back.

Add it all up and you're looking at over $400 in total damage. For a $100 chargeback.

The math doesn't work

Let's walk through exactly what happens when a $100 sale becomes a chargeback.

Step 1: You make a $100 sale

Customer pays: $100

Your product cost: $40

Your profit: $60

Step 2: Customer files a chargeback

Now watch what happens:

| What You Lose | Amount |

|---|---|

| You refund the customer | $100 |

| Payment processor charges you | $25 |

| Chargeback alert fee | $40 |

| Your staff spends 4 hours handling it | $200 |

| You already shipped the product | $40 |

| TOTAL LOSS | $405 |

Step 3: Calculate the real damage

You're out $405

You never got to keep your $60 profit

Total impact: You lost $405 and made $0

To break even: You need 4 new successful sales at $60 profit each just to recover from this one chargeback.

This is why the research shows businesses lose $3.75 to $4.61 for every $1 of revenue lost to chargebacks. That $100 sale just cost you over $400.

Multiply that by dozens or hundreds of chargebacks per month. Now you see why this is a $33.79 billion problem.

When chargebacks threaten the whole business

It gets worse. Chargebacks aren't just individual losses. They affect your standing with payment processors through something called your VAMP ratio. That's Visa Acquirer Monitoring Program.

VAMP combines both fraud reports and customer disputes into a single score. Starting April 2026, Visa's "Excessive Merchant" threshold drops from 2.2% to 1.5%. That's a 32% tighter requirement. Here's what that looks like in real numbers:

| Monthly Transactions | Combined Limit (1.5%) | What Happens |

|---|---|---|

| 1,000 | 15 disputes + fraud | Monitoring program |

| 5,000 | 75 disputes + fraud | Risk reserves frozen |

| 10,000 | 150 disputes + fraud | Account termination risk |

Cross that line and things happen fast.

Why is this getting stricter? Visa consolidated its separate fraud and dispute monitoring programs into one VAMP system. What used to be tracked separately now counts together. A transaction flagged as fraud that later becomes a dispute hits your ratio from both sides.

First, you're placed on monitoring programs. Your account gets reviewed monthly. Every chargeback gets scrutinized.

Then comes the reserve requirement. Your processor freezes 5% to 10% of your revenue as a security deposit:

| Monthly Revenue | Reserve (5-10%) | Money Locked Away |

|---|---|---|

| $25,000 | $1,250-2,500 | 1-3 months |

| $50,000 | $2,500-5,000 | 1-3 months |

| $100,000 | $5,000-10,000 | 1-3 months |

Your cash flow takes a direct hit.

If your ratio doesn't improve, your processor terminates your account. Revenue stops. You scramble to find a new processor while the business struggles.

Get terminated and you land on the MATCH list. That's the Member Alert to Control High-Risk Merchants database. Getting a new merchant account becomes nearly impossible. Legitimate businesses have closed at this stage.

That $100 chargeback isn't just costing you $400. It's one piece of a pattern that could cost you your entire payment processing capability.

The friendly fraud problem

Here's the uncomfortable part. Most chargebacks aren't even fraud in the traditional sense.

| The Problem | The Numbers |

|---|---|

| Chargebacks that are friendly fraud | 75% |

| Merchants seeing increase in friendly fraud | 72% |

| Retailers lost to friendly fraud in 2024 | $103 billion |

Friendly fraud is when customers dispute legitimate transactions. They got the product or service. They file a chargeback anyway. Sometimes it's intentional. Sometimes they just forgot about the purchase.

The problem is getting worse. Friendly fraud is expected to surge 25% during holiday shopping periods alone.

Why the increase? Social media platforms spread "refund hacks" that make chargebacks seem like a normal way to get money back. Features like instant refunds and free returns created unintended loopholes. Traditional chargeback systems can't keep up with real-time fraud attempts.

You're not just fighting actual fraud. You're fighting forgetfulness, buyer's remorse, and customers who've learned that chargebacks are easier than requesting refunds.

Why prevention is the only strategy that works

Fighting chargebacks after they're filed is a losing game. By then the damage is done. Your dispute ratio already took the hit. The fees are already charged. Your cash flow is already affected.

This is why prevention became critical. Catch risky transactions before they become disputes. You can resolve issues with customers directly. Your dispute ratio stays healthy. You avoid monitoring programs. You skip the reserve requirements. Customers get help before they feel ignored.

How Presolve stops chargebacks before they happen

Presolve was built for this exact problem. Instead of reacting after chargebacks are filed, it catches risk before it becomes a dispute.

Here's how it works. You upload your transaction list as a CSV. Presolve analyzes every individual transaction and gives each one a risk score from 1 to 5. Five is the highest risk.

When you see higher risk scores, you can act. Check in with those customers directly. Make sure everything is good with their order. If you spot something problematic, you can issue a refund right then. Before it becomes a chargeback. Before it costs you $400 instead of $100.

The chargeback never hits your account. Your dispute ratio stays clean. The fees never get charged. Your payment processing stays healthy.

Most importantly, that $100 transaction stays a $100 transaction. Not a $400+ loss.

The best chargeback to manage is the one that never happens.

Stop chargebacks before they cost you everything. Learn more about Presolve's prevention system at presolve.co.